Read on to get a closer look at recording cash disbursements in your books. Many entrepreneurs start out their small business spending and receiving cash payments. Unlike credit card payments, there is not an automatic system recording each transaction.

The information in the sales journal was taken from a copy of the sales invoice, which is the source document representing the sale. The sales invoice number is entered so the bookkeeper could look up the sales invoice and assist the customer. One benefit of using special journals is that one person can work with this journal while someone else works with a different special journal. Every business, small and large, needs to maintain a cash disbursement journal as it plays a critical role in keeping track of the cash flow for businesses.

Time Value of Money

By keeping a record of every payment made, businesses can effectively track their expenses and maintain transparency in their financial operations. After that, you only need to retain an electronic copy of the books of accounts, subsidiary books, and other accounting records. If your business includes travel, you must recognize the money you spent by recording the relevant information in your books. Write the date and check number and the description of your cash disbursement under “Particulars.” Record the amount you spent under the “Amount” and “Travel” columns. And the accounts receivable subsidiary ledger for Baker Co. would also show the payment had been posted (Figure 7.22).

The transactions would be posted in chronological order in the sales journal. As you can see, the first transaction is posted to Baker Co., the second one to Alpha Co., then Tau Inc., and then another to Baker Co. On the date each transaction is posted in the sales journal, the appropriate information would be posted in the subsidiary ledger for each of the customers. As an example, on January 3, amounts related to invoices and are posted to Baker’s and Alpha’s accounts, respectively, in the appropriate subsidiary ledger. At the end of the month, the total of $2,775 would be posted to the Accounts Receivable control account in the general ledger.

Where does the cash disbursement journal go?

The line item posting to the accounts payable ledger would be for 400 to clear the supplier account. Finally the discounts received column total of 20 (in this case assume there is only one item for the accounting period) is posted to the general ledger discounts received account. A cash disbursement journal is a record kept by a company’s internal accountants that itemizes all financial expenditures a business makes before those payments are posted to the general ledger. On a monthly basis, these journals are reconciled with general ledger accounts, which are then used to create financial statements for regular accounting periods. The manual books of accounts are those you can easily buy in the market, such as bookstores and shops selling office supplies. They are the columnar books you must fill by handwriting the accounting entries in the respective ledgers, journals, and subsidiary books.

- This article simplifies everything so you can keep a record of your accounts in no time.

- Maintaining accurate records of cash disbursements is crucial for small business owners as it helps them understand their expenses and plan accordingly.

- However, sooner or later the company has to use the cash to make payments.

- When you need to record the receipt of cash from sales to customers.

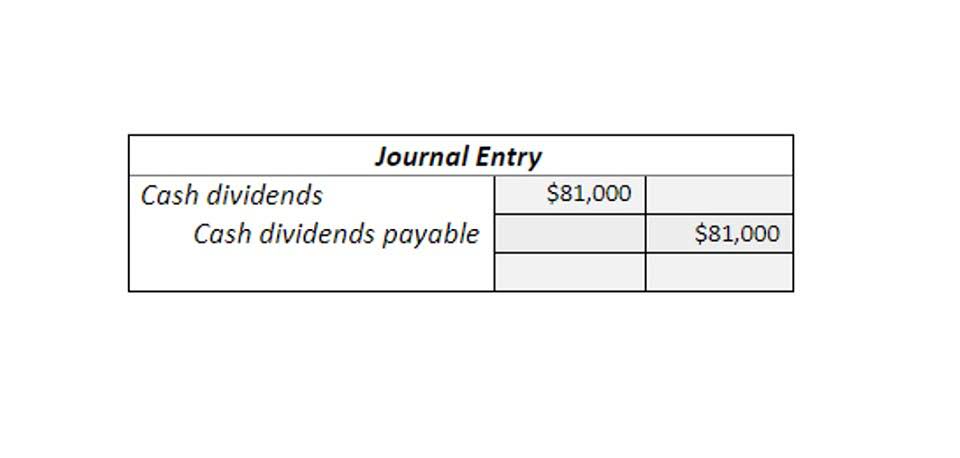

Moreover, the company may disburse cash to settle the liability of company. The company uses a cash disbursement journal as the supporting document to process payments and record them into the accounting system. Accountant will prepare the journal which is attached with purchasing document and other original documents. After that, the same document will be filed in the accounting department with a stamp paid to prevent double payment. When the company used cash to pay for purchases immediately, it will record expenses or assets on the financial statement. At the same time, the company requires to use cash to settle with suppliers.

Do you already work with a financial advisor?

The Cash Disbursements Journal is a specialized journal where you record all your cash disbursements before transferring the total amount to General Ledger. You can read our article about basic bookkeeping for more information on making journal entries and the accounting process. You debit the expense to recognize an increase in your expenses and credit the accumulated depreciation, a contra-asset account. Let us return to the sales journal, shown in Figure 7.17 that includes information about Baker Co. as well as other companies with whom the company does business. Using the reference information, if anyone had a question about this entry, he or she would go to the sales journal, page 26, transactions #45321 and #45324.